maine tax rates compared to other states

New Hampshires state income tax applies. New Jersey and New York also implement this type of millionaires tax Other states have a top tax rate but not all states have the same number of income brackets leading up to the top rate.

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent.

. But that did not happen in most states I. The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015. The state with the highest tax rate on gasoline is Pennsylvania at 0576 gallon followed closely by California at 0539 gallon.

Avg Annual State. The five top taxers were. Use this tool to compare the state income taxes in Florida and Maine or any other pair of states.

The Pine Tree States median statewide property tax rate is also. Maines percentage was 105 slightly more than the portion in Connecticut. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent.

Your average tax rate is 1198 and your marginal tax rate is 22. Lana Dolyna EA CTC. The top corporate tax rate is 893 percent.

This tool compares the tax brackets for single individuals in each state. Sales Excise Tax Rank Effective Total State Local Tax Rates on Median US. Household Difference Between State US.

The highest tax rate on diesel is 0741 gallon again from. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming. Use this tool to compare the state income taxes in Maine and Pennsylvania or any other pair of states.

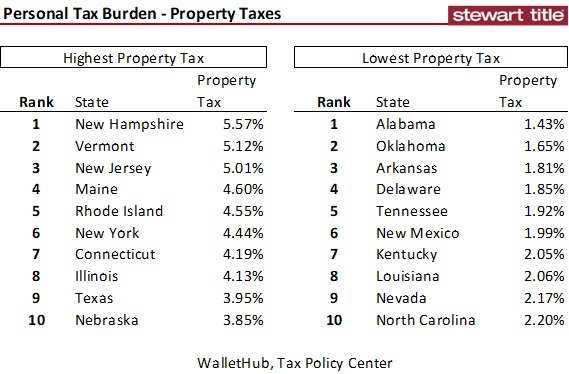

Maine Tax Rates Compared To Other States. Maine sales tax rate. According to a 2022 study on property taxes by WalletHub an average American single-family household has a median value of 217500 and.

This tool compares the tax brackets for single individuals in each state. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income. Maine has a General service provider and use tax which is for all intents and purposes very similar to the sales.

The Maine income tax has three tax brackets with a maximum marginal income tax of 715 as of 2022. Maine residents enjoy a low sales tax rate. According to the Tax Foundation the five states with the highest top marginal individual income tax rates are.

Both state and local governments hope for increased assistance from the federal government in the form of intergovernmental revenue he said. The taxes were ranked as a percentage of total personal income in each state. Detailed Maine state income tax rates and brackets are available on this page.

This marginal tax rate means. For example eight states dont have income taxes. If you make 70000 a year living in the region of Maine USA you will be taxed 12188.

Maines tax was recently raised by a half a percent from 5 to 55. Maine also has a corporate income tax that ranges from 350 percent to 893 percent. No state sales tax.

Compiled locally and calculated by the Office of Fiscal and Program Review OFPR Maines tax burden in fiscal year 2002 still ranks very high compared to other states 123 of personal. Effective Total State Local Tax Rates on Median US. Household Annual State Local Taxes on Median US.

The income tax rates are graduated with rates ranging from. Maines lowest income tax rate of 58 is higher than some other states maximum rate that should tell you something.

The 10 States With The Highest Tax Burden And The Lowest Zippia

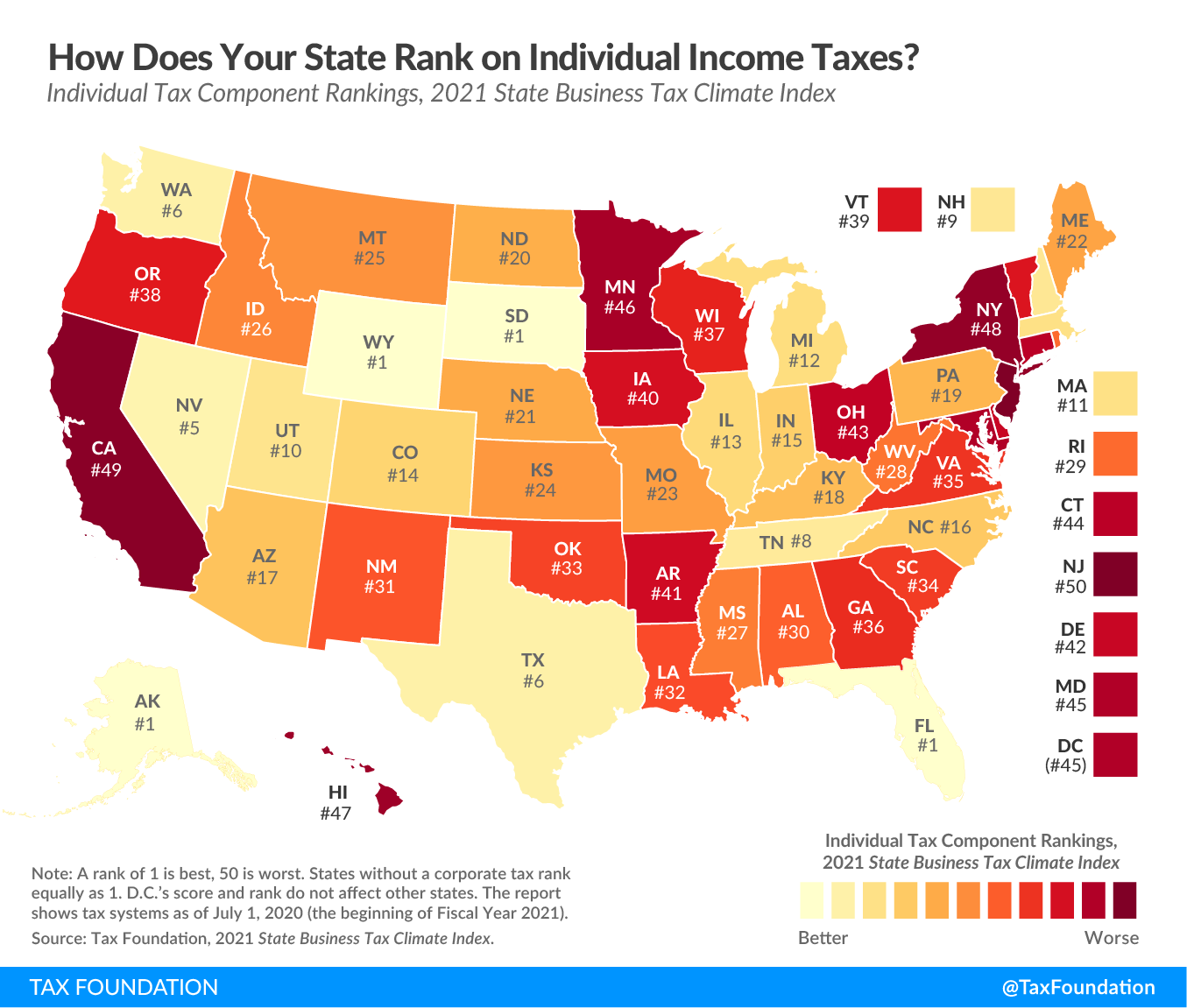

Best Worst State Income Tax Codes Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Report Tennessee Has Second Lowest Overall Tax Burden The Courier

Vape E Cig Tax By State For 2022 Current Rates In Your State

The 2015 State Business Tax Climate Index Tax Foundation Of Hawaii

Property Taxes Urban Institute

Historical Maine Tax Policy Information Ballotpedia

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

How Do State And Local Property Taxes Work Tax Policy Center

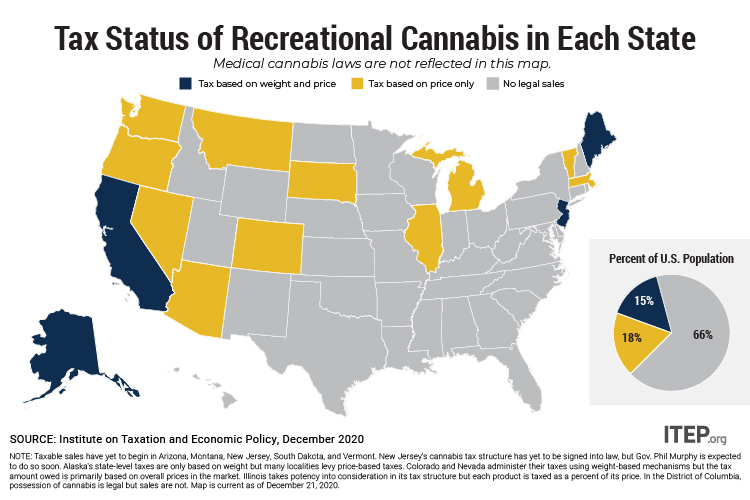

New Jersey Leads By Example With Its New Cannabis Tax Itep

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Sales Tax Rates Sales Tax Institute

Tax Burden Per Capita Other State Austin Chamber Of Commerce

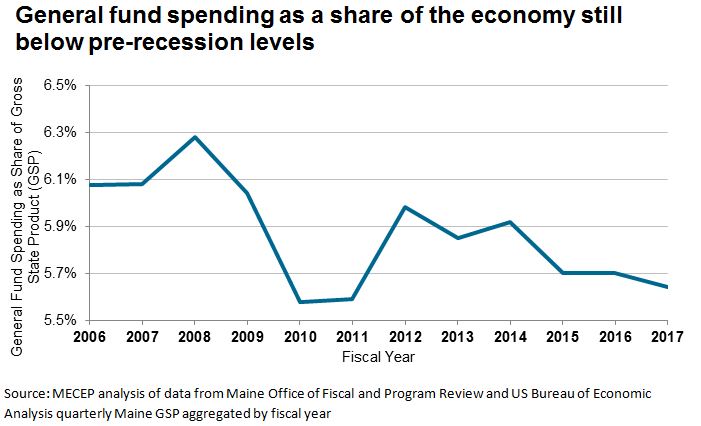

What Happens When Those With The Most Pay The Least Taxes Mecep

Maine Property Tax Rates By Town The Master List

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz